Short Intriduction:

Learn how Warren Buffett and Berkshire Hathaway built a trillion-dollar empire through strategic investments, shareholder wealth, and diversified operations.

Find out more about the amazing success journey of Berkshire Hathaway, and its foremost subsidiaries and substantial investments, and the methods that made it financially invincible. Know more about its vast insurance business, its spread product offering, and its position of strength in the market.

Table of Contents:

- Introduction to Berkshire Hathaway

- The Evolution of a Conglomerate

- The Four Giants of Berkshire Hathaway

- Insurance Operations

- BNSF Railway

- Apple Inc.

- Energy Investments

- A Closer Look at Berkshire Hathaway Insurance Businesses

- Berkshire Hathaway GUARD Insurance Companies

- Berkshire Hathaway Specialty Insurance

- Berkshire Hathaway Reinsurance Group

- Berkshire Hathaway Life

- GEICO

- Notable Investments by Berkshire Hathaway

- Key Financial Highlights

- Leadership: Past, Present, and Future

- Berkshire Hathaway’s Market Performance

- Berkshire’s Contribution to the Economy

- Conclusion

Introduction to Berkshire Hathaway

Berkshire Hathaway Inc is an American worldwide conglomerates company with its head office settled in Omaha, Nebraska, USA. One of the best diversified companies with phenomenal financial stability that cannot be overshadowed serves as today’s result of the legendary work of the chairman and the CEO, Warren Buffett. This company has diversified investment interests in insurance, rail transport, energy, and technology amongst others and is regarded as one of the world’s biggest companies with Berkshire’s stock market value being in the league of some of the highest in the world.

The Evolution of Berkshire Hathaway’s Investment Strategy

It became a holding company in 1965 after it was transformed by Warren Buffett with its roots tracing its origin from a textile manufacturing business. When teamed with Charlie Munger, Buffett helped transform the ailing textile company into a conglomerate. It has now become a model of smart capital, particularly strategic investment for long-term sustainable returns.

Key Milestones

- 1965: Warren Buffett becomes a chairman of the board at Berkshire Hathaway.

- 1978: Vice chairman Charlie Munger also joins Apple’s board.

- 2024: Berkshire Hathaway becomes the first company in the S&P 500 outside the Information Technology Sector to reach $1 trillion in market capitalization.

The Four Giants of Berkshire Hathaway

1. Exploring Berkshire Hathaway’s Insurance Operations

Insurance operation is Berkshire Hathaway’s most profitable segment, offering the company funding – or ‘float’ – which allows it to invest. The conglomerate’s insurance operations are wholly owned and include prominent names such as:

- Berkshire Hathaway GUARD Insurance Companies: Endeavours go into property and casualty insurance.

- Berkshire Hathaway Specialty Insurance: Concentrates on commercial property and professional liability of healthcare practitioners.

- (GEICO): The largest insurance company offering car insurance services in the US with a flexible premium charge.

2. Berkshire Hathaway’s Key Investment in BNSF Railway

Berkshire bought BNSF Railway in 2010 as part of its network of freight rail in North America, which is generating a major share of its revenue. The railroad industry serves an important role in the hauling and shipping of freight throughout the United States.

3. Apple Inc. and Berkshire Hathaway’s Technological Investments.

Currently, Apple Inc has its shares being owned by Berkshire Hathaway to the tune of 20 percent. This investment indicates a bias towards the technological industry by Buffett as the investment niche.

4. Energy Investments: A Stronghold of Berkshire Hathaway

It has a subsidiary known as Berkshire Hathaway Energy through which the company has focused on utility services investment, renewable power, and consistent innovations.

Berkshire Hathaway Insurance Companies: A Detailed Overview

Berkshire Hathaway GUARD Insurance Companies

Through subsidiaries like AmGUARD and NorGUARD, this segment deals in property and casualty insurance. Due to this, it offers solutions for small and medium-sized companies to address various needs.

Berkshire Hathaway Specialty Insurance

This arm offers everything from professional liability, property and casualty, to workers compensation and commercial auto insurance solutions. Being one of the leading insurance companies, it has a strong financial position besides having a good reputation for addressing customer needs.

Berkshire Hathaway Reinsurance Group

This one is amongst the biggest reinsurers in the world, and it specializes in property, casualty, life, and health reinsurance. This is well endowed and has the ability to practice disciplined underwriting, which puts the company among the market leaders.

Berkshire Hathaway Life

Currently, the largest life insurer in the conglomerate is Berkshire Hathaway Life, which has leading ratings from Standard & Poor’s (AA+) and A.M. Best (A++), emphasizing its financial security.

GEICO

As aggressive in advertising as it is in its charges, GEICO is a very popular auto insurance company. Berkshire Hathaway owns it directly, and it is an important player in the insurance operations of the overall company.

Notable Investments Driving Berkshire Hathaway’s Success

Beyond its wholly-owned businesses, Berkshire Hathaway holds significant stakes in major corporations.

| Company | Stake (%) | Value (Billion USD) |

| Apple Inc. | 20.0% | 69.8 |

| American Express | 21.5% | 46.2 |

| Bank of America | 9.99% | 36.4 |

| Coca-Cola | 9.2% | 23.2 |

Investment Philosophy

In fact, the investment approach that Buffett has employed throughout his investment career involves buying cheap companies with sound characteristics and keeping them for as long as possible. It has been proven that this approach would always yield very high returns.

Berkshire Hathaway’s Financial Performance and Growth

Revenue and Earnings

- 2023 Revenue: $302 billion

- 2023 Net Income: $37 billion

Cash Reserves

With about $325 billion in the bank, that is either being saved in cash or equivalents by September 30, 2024, the firm was the biggest holder of cash and cash equivalents than just about all other U.S. public firms.

Long-term Performance

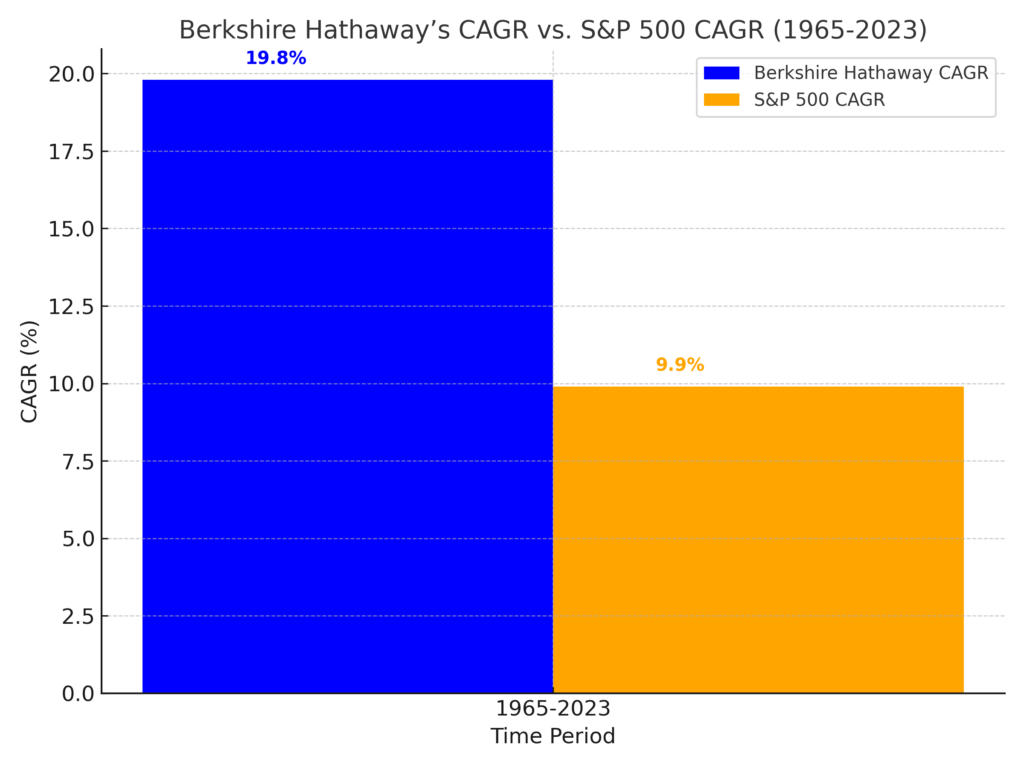

From 1965 to 2023, the compounded annual return rate to shareholders at Berkshire Hathaway was 19.8% while that of S&P 500 was 10.2%.

Chart: Berkshire Hathaway’s CAGR vs. S&P 500 CAGR (1965-2023)

A bar chart comparing CAGR values:

Leadership at Berkshire Hathaway: A Legacy of Success

Warren Buffett and Charlie Munger

The pair of Buffett and Munger turned the struggling textile company, Berkshire Hathaway, into a world giant. While Buffett was busy investing, Munger offered more tactical direction for the company’s prior securing.

Greg Abel: The Future CEO

Greg Abel, who has been managing Berkshire Hathaway’s portfolio for years, has been groomed for this position. He would be outlining the course for the company in the next paradigm.

Berkshire Hathaway’s Market Performance and Value

Stock Price Highlights

Some of the most expensive companies in the world that share trading at major exchanges include: In August 2024, the stock price of Class A of Berkshire Hathaway company reached $700,000, making them the highest priced publicly traded stock in the world. This is confirmed by the company’s policy against stock splits, which showed that it was more concerned with price appreciation.

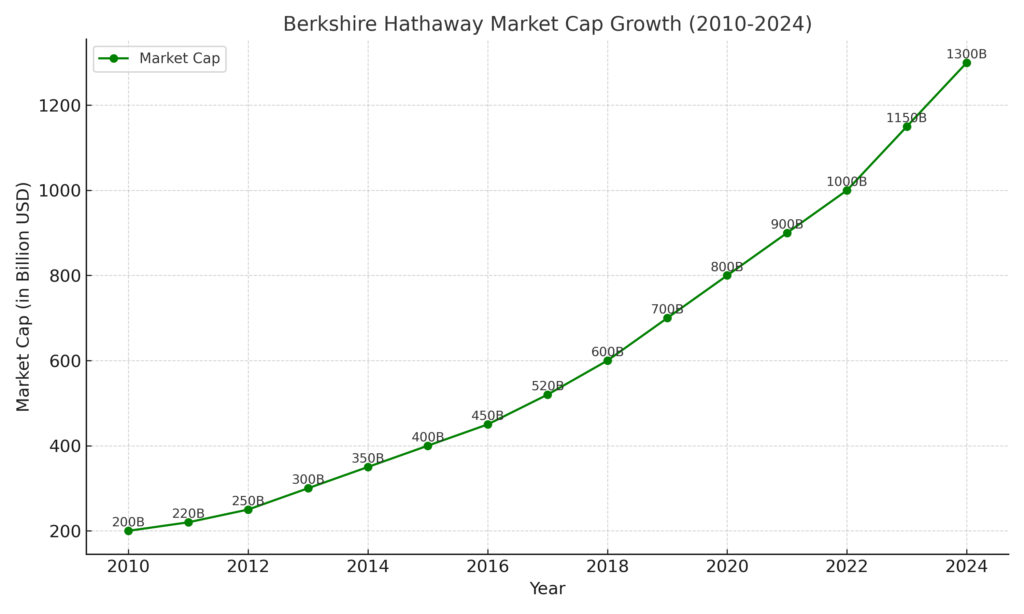

Market Capitalization

In August 2024, for the first time, Berkshire Hathaway’s market capitalization hit $1 trillion, and this is not a tech company.

Chart: Berkshire Hathaway Market Cap Growth (2010-2024)

Market capitalization over the years:

Berkshire’s Contribution to the Economy

Employment

Berkshire Hathaway currently employs thousands of people and operates in lines of business such as railroads, utilities, and manufacturing.

Philanthropy

Over time, Buffett has embraced the Giving Pledge and taken Berkshire Hathaway to commit hugely on philanthropic programs across education, health, and poverty eradication.

Conclusion

Berkshire Hathaway’s transformation from a dying textile company to a $1 trillion dollar company is a classic text on strategic thinking and executional excellence. Sustaining a strategic mix of business and investment verticals, the company goes on to establish new standards of financial and corporate excellence. When the company is transitioning to the new management led by Greg Abel, Berkshire Hathaway stands firm as one of the most successful examples in business.